Pvm Accounting for Dummies

Pvm Accounting for Dummies

Blog Article

The smart Trick of Pvm Accounting That Nobody is Discussing

Table of ContentsThe Facts About Pvm Accounting UncoveredA Biased View of Pvm AccountingPvm Accounting for BeginnersThe Basic Principles Of Pvm Accounting The Only Guide for Pvm AccountingIndicators on Pvm Accounting You Should Know

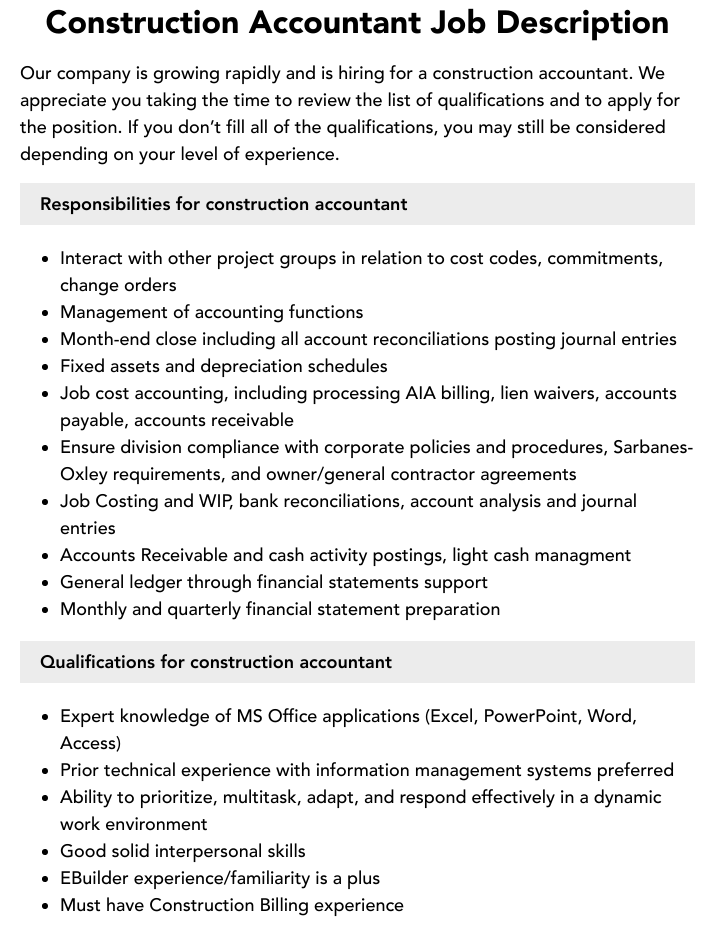

Manage and deal with the creation and authorization of all project-related invoicings to consumers to promote excellent interaction and prevent concerns. Clean-up bookkeeping. Make certain that appropriate records and documentation are submitted to and are updated with the internal revenue service. Guarantee that the bookkeeping procedure abides by the legislation. Apply called for building accounting criteria and treatments to the recording and reporting of building activity.Connect with various financing companies (i.e. Title Company, Escrow Business) concerning the pay application procedure and requirements required for repayment. Aid with carrying out and maintaining inner monetary controls and treatments.

The above statements are planned to describe the basic nature and degree of work being executed by people appointed to this classification. They are not to be taken as an extensive listing of obligations, obligations, and skills required. Workers may be needed to perform obligations outside of their typical duties periodically, as required.

Pvm Accounting - Questions

You will certainly help support the Accel team to make sure shipment of successful in a timely manner, on spending plan, projects. Accel is seeking a Building Accountant for the Chicago Office. The Building Accountant executes a variety of accountancy, insurance policy compliance, and task administration. Works both separately and within specific departments to preserve monetary documents and ensure that all records are maintained present.

Principal responsibilities consist of, however are not restricted to, taking care of all accounting functions of the business in a timely and exact way and providing reports and timetables to the company's CPA Firm in the preparation of all economic statements. Ensures that all bookkeeping procedures and functions are handled precisely. Liable for all economic documents, pay-roll, financial and day-to-day procedure of the audit feature.

Works with Job Managers to prepare and upload all regular monthly invoices. Generates month-to-month Task Price to Date records and working with PMs to integrate with Job Managers' spending plans for each task.

Things about Pvm Accounting

Effectiveness in Sage 300 Building And Construction and Realty (previously Sage Timberline Office) and Procore building and construction monitoring software application a plus. https://pvm-accounting-46243110.hubspotpagebuilder.com/blog/building-financial-success-with-construction-accounting. Have to likewise be competent in other computer system software application systems for the prep work of reports, spread sheets and other bookkeeping evaluation that might be called for by monitoring. construction accounting. Must have strong business skills and capability to prioritize

They are the economic custodians that make sure that construction tasks stay on budget, conform with tax obligation regulations, and preserve monetary transparency. Building and construction accountants are not simply number crunchers; they are strategic companions in the building and construction procedure. Their main duty is to handle the financial aspects of construction projects, making sure that sources are designated successfully and financial risks are minimized.

A Biased View of Pvm Accounting

By preserving a limited hold on project funds, accountants help protect against overspending and economic troubles. Budgeting is a foundation of successful building jobs, and building and construction accountants are important in this respect.

Browsing the complicated web of tax policies in the building sector can be difficult. Construction accountants are skilled in these policies and make sure that the project adheres to all tax obligation requirements. This consists of managing pay-roll tax obligations, sales tax obligations, and any other tax obligation responsibilities particular to building. To succeed in the duty of a building and construction accounting professional, individuals need a strong academic structure in audit and financing.

Furthermore, accreditations such as Licensed Public Accounting Professional (CPA) or Licensed Construction Sector Financial Expert (CCIFP) are extremely related to in the sector. Building and construction tasks commonly involve tight deadlines, changing regulations, and unexpected costs.

How Pvm Accounting can Save You Time, Stress, and Money.

Expert certifications like certified public accountant or CCIFP are also highly recommended to show competence in construction accounting. Ans: Construction accountants produce and check spending plans, determining cost-saving possibilities and making sure that the task stays within budget. They also track costs and projection financial needs to stop overspending. Ans: Yes, building accountants manage tax obligation compliance for construction tasks.

Introduction to Building And Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building companies need to make tough selections amongst lots of economic options, like bidding on one task over an additional, selecting financing for products or equipment, or establishing a project's earnings margin. On top of that, building and construction is an infamously volatile market with a high failure rate, sluggish time to settlement, and inconsistent capital.

Common manufacturerConstruction service Process-based. Production involves duplicated processes with quickly recognizable expenses. Project-based. Production calls for various processes, products, and equipment with varying costs. Fixed location. Manufacturing or production takes place in a single (or numerous) controlled locations. Decentralized. Each task takes location in a brand-new place with varying website problems and unique challenges.

Pvm Accounting for Beginners

Long-lasting relationships with suppliers alleviate negotiations and enhance performance. Irregular. Regular usage of various specialty service providers and suppliers influences effectiveness and capital. No retainage. Repayment shows up completely or with normal repayments for the full contract quantity. Retainage. Some part of repayment might be held back up until job completion also when the specialist's work is completed.

Regular production and temporary agreements bring about convenient money flow cycles. Uneven. Retainage, slow-moving payments, and high ahead of time expenses result in long, uneven capital cycles - construction accounting. While traditional suppliers have the advantage of controlled settings and enhanced manufacturing procedures, building and construction look at these guys business should frequently adjust per brand-new job. Even rather repeatable jobs require modifications as a result of site conditions and various other aspects.

Report this page